After years of investing, there have been several investing principles I learned regarding the stock market. One of them is this: Good investing is not about understanding the numbers; it’s about understanding human behavior.

Human behavior is driven by emotions. Which is why the economy and markets are not predictable. As I’m writing this in December 2023, we’re still waiting for a recession that many pundits have been predicting for two years.

I recently read Morgan Housel’s book, Same As Ever, which is about all the things in the world that don’t change. After all, those are the only things we can really count on.

As Housel writes, this is the reason we can’t predict the future:

“We are very good at predicting the future, except for the surprises—which tend to be all that matter.”

So for passive investors, it’s best to look out for investing elements that never really change. And then use that knowledge to buy peace of mind. When you have peace of mind, you can focus on building wealth.

Here are four of those things about investing that never change.

1. Successful Investing Requires Doing Nothing

Action is not always equal to progress. Investing is an art. And it sometimes requires doing nothing, even if you’re itching to take action. The value investor, Mohnish Pabrai, once said:1Source: Forbes

“The single biggest advantage a value investor has is not IQ. It’s patience and waiting. Waiting for the right pitch, and waiting for many years for the right pitch.”

Investing is a game of patience and discipline. A smart investor knows how to resist the urge to react to every market fluctuation and news headline. Here’s the thing: the market will always have its ups and downs.

And unless we’re really deep in an industry, we are unlikely to predict what kind of world disaster might happen (like Covid) or what new technology would come out. And even folks in an industry don’t make accurate decisions much. Otherwise, every industry expert should be rich from the stock market.

That’s why the key to successful investing is to stay the course, remain patient, and resist the urge to make impulsive decisions.

2. The Best Strategy is the Simplest Strategy

Like most things in life, simplicity wins over complexity.

As of Q2 2023, Warren Buffett’s Berkshire Hathaway has over $348 billion invested in just 48 stocks.2Source: Forbes This shows that you don’t need a complex portfolio with hundreds of positions to achieve investment success. In fact, the opposite is often true.

Consider the following:

- Focus: A concentrated portfolio allows you to focus your attention on a select group of companies that you understand well. Likewise, if you’re investing in the S&P 500 index (which tracks the stock performance of the 500 largest companies in the US), you free yourself from having to watch the markets every single day.

- Alignment: The best investment strategy is the one that aligns with your character and investment style. Warren Buffett is a successful investor because his investment style aligns with his nature.

- Patience: Many people lack the patience to pick stocks and would be better off investing in low-cost index funds.

Most people wouldn’t enjoy watching out for price changes every single day. We all have lives to live, careers to work on, and relationships to grow. Only the people who are working as traders can afford the time to carefully watch their investments.

That’s why passive investing is key: You leverage the market growth to your benefit. Then prevent risk by investing in a basket of the best stocks.

3. Stick to Low Costs and Fees

The management fee for a mutual fund (a basket of stocks selected by fund managers) typically ranges between 0.5% and 1% of the total value of the fund each year.

An annual fee of 0.5% might seem small. But that’s a constant amount you’ll lose over time. The fees would compound over the years. Just imagine investing $500 every month in the S&P 500 index for your retirement. And you kept that up for 35 years before you retired.

The S&P 500 index has an average annual return of 10.7% in the past 30 years.3Source: Motley Fool That means your $500 monthly investment would likely turn into $2,116,045 by the end of year 35. With compounding, your total fees would amount to $239,588.4Source: Get Smart About Money Fee Calculator And instead of $2.1 million, you’ll only go home with a little over $1.8 million.

$239,588 — lost. You could’ve used that money for a long vacation abroad, a major house upgrade, a luxury car, or extra backup funds.

Therefore, it’s crucial to choose investment options with low costs and fees. This includes not only the expense ratios of the funds you invest in but also transaction costs, taxes, and any other fees associated with your investment account.

4. The Stock Market is More Emotional, Less Logical

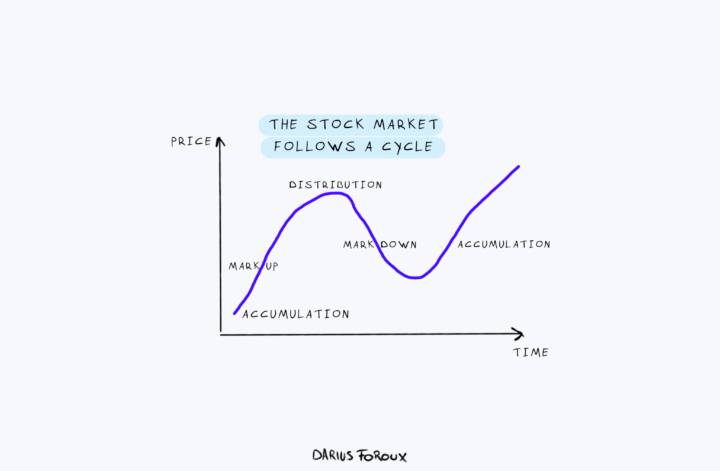

In the short term, the stock market is emotion-driven. Fear and greed are powerful forces that can cause investors to make irrational decisions. This leads to a lot of price volatility.

But in the long term, the market tends to reflect the intrinsic value of companies.

This principle serves as a reminder to look beyond the short-term noise and focus on the long-term fundamentals of the companies we invest in. As Warren Buffett said:

“The stock market is a device for transferring money from the impatient to the patient.”

As investors, we should strive to be on the right side of this transfer. Try to stick to a long-term investing strategy. And keep emotions out of your investment decisions as much as you can.

Some things remain the same despite all the changes

The news always talks about the things that change. And that’s fine. Change is always happening around the world. But focusing too much on the news warps our perspective.

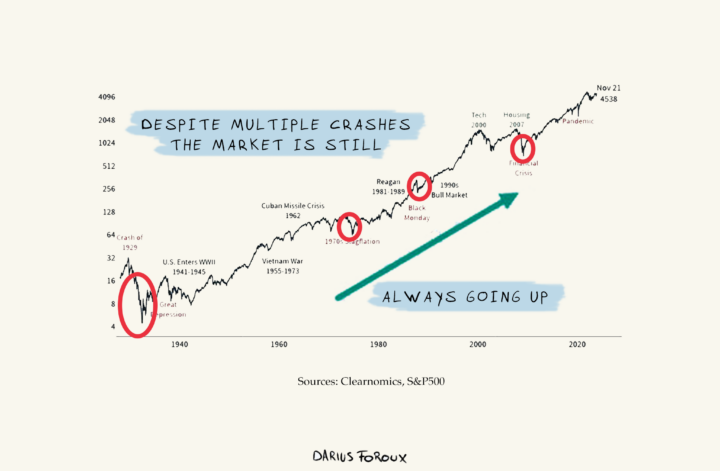

So it’s best to remind yourself about the nature of the stock market: The New York Stock Exchange has been operating for over a hundred years. It’s likely going to stay for another hundred more, or longer than our lifetimes.

The market goes up and down every year. But when you look at the past 30 years, it’s consistently been going up. Despite wars, pandemics, and so forth.

Meanwhile, things like human nature generally stay the same. And only those who can stick to a sustainable long-term investing strategy can thrive.