My brother, Daniel, who’s seven years younger than I am, told me the other day that he doesn’t feel like investing because he can’t invest a lot of money. So I said, let’s do some calculations. I’ll show you that you can become a millionaire by investing small amounts of money.

My goal is to destroy one of the biggest myths of wealth-building which is that you can only get rich by investing big lumps of money. Here’s where it comes from. Let’s say you want to start investing in an S&P 500 index fund. It’s a relatively low-risk way of getting started.

And you put in $1000 of your money and you wait a year. And you see something like 8% returns, which is about the average for the past 30 years. And you think, “$80? That’s all? What am I supposed to do with that?”

How about adding more money? That’s the thing I never understood about investing when I started. The goal of investing is not to generate short-term cash—that’s what your career or business does.

The goal of investing is to allocate your capital to assets that usually appreciate over time: Stocks, real estate, land, and so forth. But that appreciation is often underwhelming in the short term.

Assets don’t move much on a day-to-day or even month-to-month basis. Take a look at Apple stock over the last three months:

Source: Yahoo Finance

Not impressive, right? It started February around $135, went down about $20, and then climbed back to around $130. If you bought it at the height in February, you had a negative return of about 3%. But take a look at what Apple stock did over the past 10 years:

Source: Yahoo Finance

That’s a return of 962%. $10,000 invested in Apple ten years ago would turn into $106,200.

Become a millionaire with compounded returns

I told my brother about how I adjusted my horizons when it came to investing. That helped me to be more patient and focus on building actual wealth. So here’s a summary of our conversation about the “500 bucks a month” calculation I mentioned.

I asked, “How much can you start with right now? The money you don’t need within the next year. Excluding about six months’ worth of expenses that you want to keep on your savings account.”

“I can miss about 2000 bucks right now,” Daniel said.

“Ok great, let’s put that in the Vanguard S&P 500 index fund. That’s a more reliable strategy than picking individual stocks.”

Daniel said, “And then what? Even if it does 10% a year over the next years, that’s not that much money.”

“True,” I said, “But that’s not all. Investing is not something you do once. It’s a habit. How much can you miss every month from next month?”

“I don’t know. 100 bucks?”

“C’mon man. You make more than that. You could miss $500. Just spend less on bullshit,” I said.

“Where are you going with this?”

“So you start with $2000 in the index fund. You add $500 every month from now. Doesn’t matter how high or low the market is. Just add your 500 bucks every month.

Let’s say the S&P 500 will keep doing 8% a year for the next 35 years. You’ll be a millionaire at 62. You’ll end up with $1,100,854.48.”

“Nice.”

“That’s the power of compounded returns.”

Build the habit of investing

Investing is not a goal, activity, or task; it’s a habit. It’s something you do regularly, just like you work out, meditate, read, or anything else that takes time to yield results.

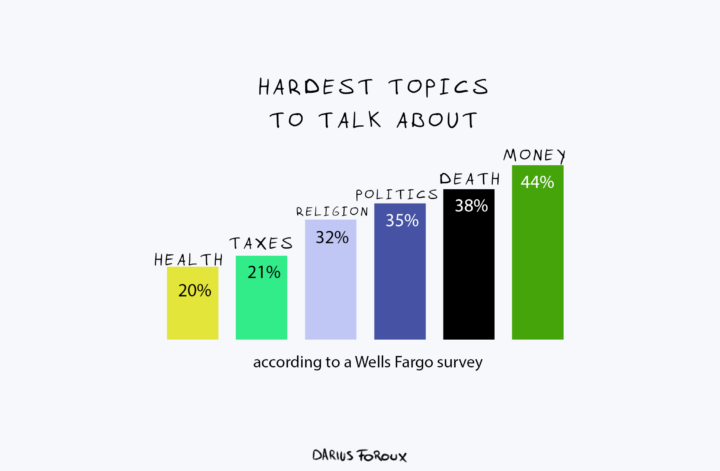

I’ve been talking about investing with my peers for years now, and it’s sad to see so few of them actually invest. And it’s true on a macro level as well.

People assume that investing is for the rich and that it’s fruitless to invest a few hundred bucks a month. That’s false. And yet, it’s stopping millions of people from investing.

That’s a shame because most of us will never earn a lot of money in a year. Only 1% of Americans earn more than $500,000 a year (and this percentage is probably much lower in other developed countries). While it might sound enticing to earn a lot of money, earning more also comes with more problems.

If you’re earning an above-average wage, you’re no worse off than someone who makes half a million or more. And so what if 1% of the population earns a lot of money? It’s only a problem if we don’t profit from capital gains, which is actually how the rich get richer.

Every single person needs some form of exposure to assets that appreciate over time, whether that’s in the stock market, real estate, or something else. The point is that you build wealth over time. Investing wisely can help you to have more financial stability when you retire.

And if you want to be a millionaire? While it’s not a guarantee, you could do that over time with $500 a month like the example I shared with my brother.

But that’s not the point of this thought experiment. Not everyone needs or wants to be a millionaire. If you live in a place with a relatively low cost of living, you could put aside $100 and still be better off than putting $0 aside.

That’s the point. Think ahead. Invest. And sleep well at night.