To be a good investor, you need a deep understanding of human psychology and behavior.

The first time I heard about that was when a friend told me to read Poor Charlie’s Almanack in 2015. It’s a book about the investing style of Charlie Munger.

So I bought the book, started reading it, and thought, “What does this have to do with investing?”

I found it very insightful, but at the time I didn’t grasp why the book was mostly about investor behavior.

You’ll find a lot of ideas about what not to do as an investor. You’ll learn about the most common mistakes. But you won’t get a step-by-step program for investing in stocks like Charlie Munger or Warren Buffett.

Since then, I’ve learned that investing is mostly a matter of a deep understanding of human behavior. Just reading a few mainstream books on psychology isn’t enough.

It takes years to learn enough about human behavior to apply it to investing. For me, this understanding only started to come in the past two years.

I must say I’m not the quickest learner or particularly gifted. I was average at best during my educational career. And I learn slowly.

But I’ve been casually learning about investing since 2007, and very seriously (reading one or two books a week) since 2015. Many years, hundreds of books, and thousands of conversations about investing later, I finally understand why Munger emphasizes the importance of understanding human behavior.

This sound obvious when I say it in my head right now.

The stock market consists of human participants. What happens in the stock market in the short-term and long-term is a result of the behavior of the participants.

That doesn’t mean there’s no skill involved with investing in the stock market. It’s simply not the determining factor. A person with perfect knowledge of evaluating stocks will not build wealth without understanding human behavior.

Human behavior never changes, hence, investor behavior never changes

And therefore, markets will never change.

Keep this in mind next time you watch a video or read a piece that talks about how investing has changed forever now because of xyz.

In 2022, a common story you’ve probably heard is this:

- Global federal reserves had extremely loose monetary policy since 2008

- That has changed and interest rates will go up

- The Fed will no longer save the stock market

- Hence, you shouldn’t expect much from the stock market, and you definitely shouldn’t buy growth stocks

There’s one problem with this narrative: Humans.

We’re so forgetful that we will pick up right where we left off before you know it. Once the world’s crises are somewhat resolved, we’ll do the same thing as before.

And that is: Buy, buy, buy, as our friend Cramer always says.

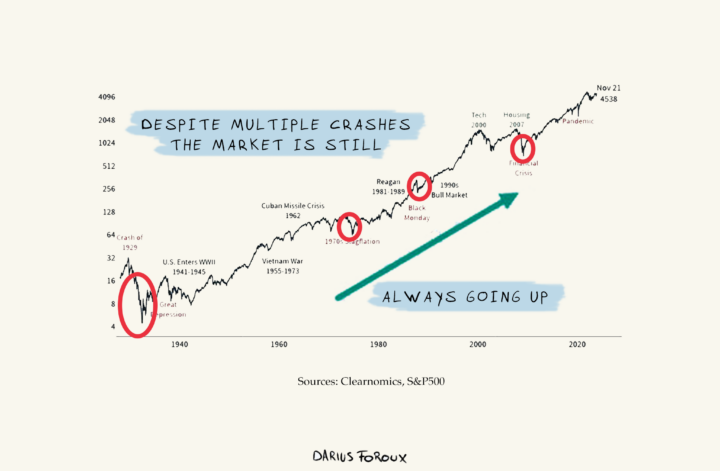

That’s what investors did after The Great Depression, WWII, inflation of the 1970s, Dotcom bust, 9-11, The Financial Crisis, and all the other big events that supposedly should’ve changed investor behavior.

Humans never change. The stock market never changes.

I don’t mean that in a dismissive way as in, “Oh, people are so bad. That will never change. We’re doomed.” When I talk about human behavior, I talk about it in a non-judgmental way. I try to understand what we usually do, and not necessarily whether it’s good or bad.

To be a good investor, we should not only focus on learning the fundamentals or technicals of investing, we should also learn about the behavior of humans. Not just in the stock market but in life.

When you learn lessons about the nature of humans, you can apply those lessons to what’s going on in the world. This is also why investors like Munger often read widely from biographies and philosophy to history books.

They are not only interested in learning about human behavior to gain an edge in the stock market; they are simply curious about these topics.

When you let go of your expectations to get rich in the stock market, you can focus on the beauty of the market. It’s truly one of the most fascinating inventions of the world.

Where else can you go to learn about money, businesses, psychology, history, and most importantly: About yourself. The stock market is a ruthless system that punishes your mistakes with a vengeance. But it also rewards you when you do the right thing.

That’s what makes it so beautiful; because it’s honest.