Charlie Munger once said: “More investors don’t copy our model because our model is too simple. Most people believe you can’t be an expert if it’s too simple.” The simplest investing ideas are truly the best.

Munger was the best at simplifying investing ideas. Together with his partner, Warren Buffett, they invested hundreds of billions of dollars in companies. And every time they were interviewed, they kept it simple.

They stressed that execution matters more than ideas. Munger and Buffett never did anything secret and dozens of books have been written about their investing strategy. They simply executed on another level.

In the vein of Munger, here are 5 simple ideas that will make you rich if you execute them strictly.

1. If you have freedom, you have wealth

Why do you invest in the first place? This is an important thing to think about for everyone.

Most start investing because they want to have more financial stability. Others see it as a profession. And some find it an intellectually fulfilling pursuit.

No matter with what intention you start, it’s tempting to forget that and focus on acquiring more money.

A lot of people fall into the trap of endlessly chasing more money. They wait to feel fulfilled until they have a certain amount of money in stocks or the bank. But wealth is more a feeling than a number.

Wealth isn’t just about accumulating money; it’s about financial stability and freedom. It’s the ability to weather financial emergencies, the freedom to make choices that aren’t dictated by financial constraints, and the peace of mind that comes from knowing you’re financially secure.

High earners can still struggle financially if they spend recklessly and save little. On the other hand, those with modest incomes can accumulate substantial wealth by living frugally and saving diligently. This is where simple investing ideas come in.

When you focus on setting your life up in a way that you have freedom, you can call yourself wealthy. And you can feel free even if you’re not a millionaire.

2. Complexity doesn’t mean better returns

Innovation and complexity are often hailed as drivers of value in the modern economy. Yet, the reality is that value is not always tied to how novel or complex a product or service is.

If that were true, everyone with genius-level intelligence would be rich. Good math skills also don’t translate to good investing skills.

Many assume that investors who rely on mathematical models and use automated trading systems always perform better. Some do, some don’t.

As an individual investor, your best bet is to avoid complexity. The simpler the investment, the better.

3. The best antidote for high-interest rates is to save more money.

High-interest rates are often perceived as a negative to financial growth, making loans and credit more expensive.

Sure, borrowing can be expensive. But there’s a very simple fix for that.

Save more and don’t borrow. Want to lease a car? Don’t. Buy a used one with your cash.

By increasing the amount of money you put aside, you build a financial buffer that you can always use. Especially during times of high interest.

In addition, the practice of saving also promotes financial discipline and reduces reliance on borrowing, further enhancing your financial stability.

4. Dollar-cost averaging is the best passive investing strategy

Dollar-cost averaging (DCA) is an investment strategy in which you invest a fixed amount of money in a particular investment on a regular schedule, regardless of the price.

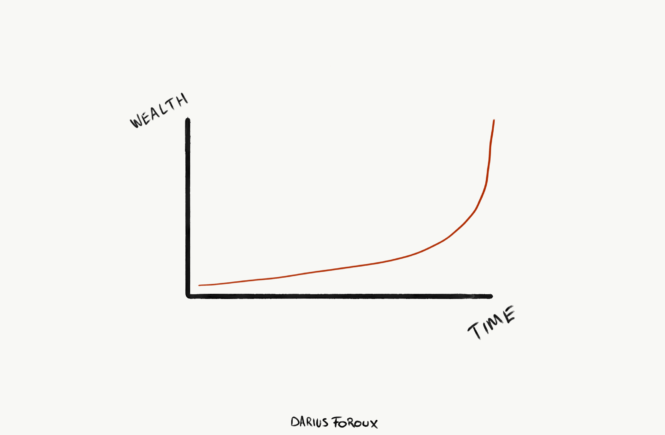

This not only ensures consistent investment over time but also reduces the impact of volatility on the overall purchase. The idea is that by investing a consistent dollar amount, you’ll buy more shares when prices are low and fewer when they’re high.

This strategy has two main advantages. First, it eliminates the need to time the market. You don’t have to worry about buying at the ‘right time’ because your investment is spread out over time. Second, it mitigates the risk of making a substantial investment at a single point in time, only for the value to drop shortly after.

DCA is a disciplined strategy that focuses more on the habit of investing rather than reacting to market conditions, making it a practical approach for long-term investors. The simplicity of this strategy shows that investing doesn’t need to be complex to succeed.

5. Avoid what you don’t understand

One of the most valuable pieces of investing advice is to avoid entering into financial arrangements or investing ideas that you don’t fully understand.

The lure of high returns can sometimes blind us to the inherent risks associated with certain investments. Not only does a lack of understanding about an investment often result in loss, but it will also mess with your sleep!

To me, that’s the biggest reason I stick to what I know. For example, I avoid crypto and complex financial instruments.

I own real estate and stocks. That’s what I stick to, and it helps me to focus.

This doesn’t mean you need to be an expert on every detail, but you should have a clear idea of how the investment works and what the potential risks are.

Financial education never ends

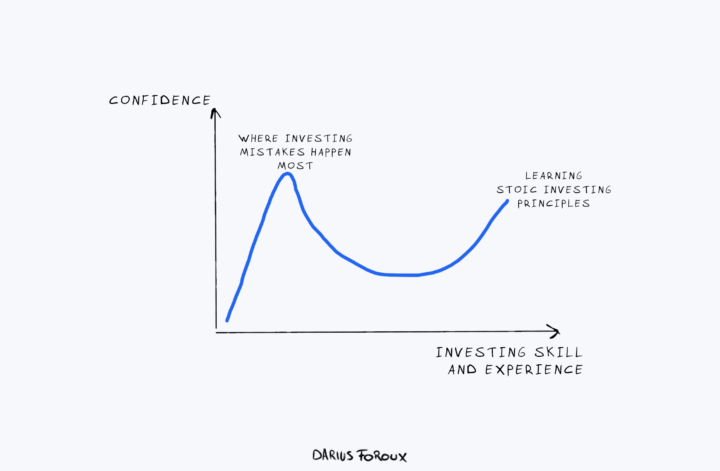

Even if you keep your investing strategy simple, it doesn’t mean you will always do well financially.

To keep building wealth, we need to keep acquiring more financial knowledge. Financial literacy is not a destination but an ongoing journey.

The more you learn about personal finance and investing, the better equipped you’ll be to navigate the complexities of the financial world.

So, when confronted with an investment opportunity or financial decision, take the time to do your research. Ask questions, seek advice from trusted advisors, and make sure you understand what you’re getting into before you commit your hard-earned money.

I bet that none of the ideas sounded like new information to you. This was the point that Munger was making.

Investing is simple. Keep it that way.