For ordinary folks like you and me, becoming financially stable can be summed up in a few words: Spend less, earn more. When you save and invest consistently, you gradually build up your wealth until you reach the point where you have a comfortable nest egg. And you don’t have to work anymore.

“But it’s so hard to save a good chunk of your income!”

That’s true. If it were super easy to save and invest, more people would be financially stable right now. Instead, most Americans can’t even afford to pay for a $1,000 emergency. Because most folks don’t have a good emergency fund.1Source: Yahoo! Finance

The thing is, “spend less, earn more” is a mindset, not a strategy. The 5 items I’m about to give you in this article are strategies. But they won’t work if you don’t have the right mindset.

Back in the day, one of the most popular personal finance blogs I followed was Mr. Money Mustache. He talked about the Bed Pan and Catheter slope of consumerism:

“Let’s suppose you want the latest iPad. You want it because it is convenient to be able to look at pictures and websites and books and play music around the house. Sure, you already have other computers that do those things, but the iPad is special because it lets you do them while holding it in one hand, sitting on the couch.

Wow, that couch is pretty convenient too, isn’t it? It is comfortable, enjoyable, convenient, and joyful to sit and lie on. In fact, wouldn’t it be best to just lie on that couch all day? Forever? Yeah! Maybe you could even hook it up with a catheter and a bedpan, and a friend or robot could bring you all your food on the couch too.”

Maybe the first bit of the paragraph appealed to you. Then you likely lost interest by the time you reached the catheter and bedpan. But when you think about it, almost any unnecessary purchase slides towards that slope when you put it to the extreme.

In the end, consumerism is all about making everything as easy as possible — even when that convenience is no longer necessary. Take buying a car, a watch, or even a pair of pants. Advertisers love to convince customers that their items define their worth.

“Buy this brand right now! It will make your friends think you’re a hotshot!”

Here’s the truth that advertisers don’t want you to internalize: You can live with far less and still be happy.

I’m not saying deprive yourself. Simply avoid buying things you don’t need. And that’s a lot of things you see mostly in the malls, shopping sites, and social media.

When you have that mindset, spending less and earning more become more automatic for you. That’s the “easy” path to becoming financially stable. Because you’re focused on spending only on things that truly matter to you.

1. Avoid the “I deserve this” mindset

Yes, you worked hard for your money. And that’s exactly why you deserve to not waste it.

You don’t need to try out all the food trucks near the office, rush to the mall for the big sale, and travel during holidays. Try not to go shopping, dining out, or traveling purely because of peer pressure. Instead, ask yourself:

“What do I truly want? And what small actions can I do to get it?”

That’s a more practical mindset. It also ensures you get what you want, and not what other people expect you to.

2. Avoid budgeting. Focus on income generation

A scarcity mindset won’t make you rich. I’ve talked about why budgeting is not the best path to financial freedom.

There are times when money is especially tight and you need to conserve your resources. That’s when you use budgeting. But keep it temporary. Eventually, you can reach a point where you have a bit more breathing room. Many people eventually start earning more with their job or business.

When that happens, sticking to an overly tight budget would cease to be useful.

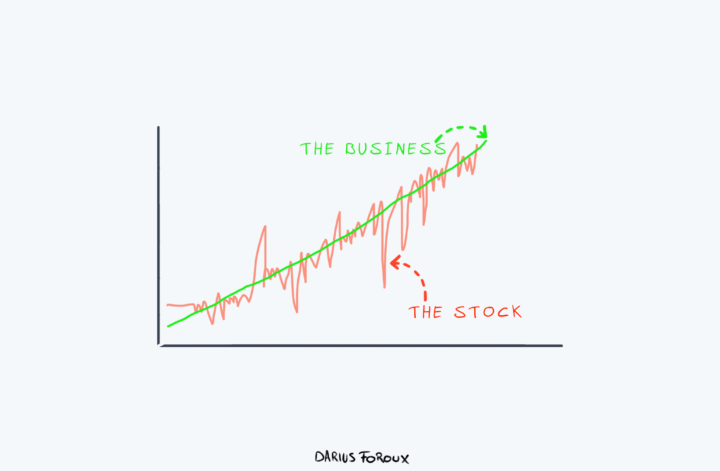

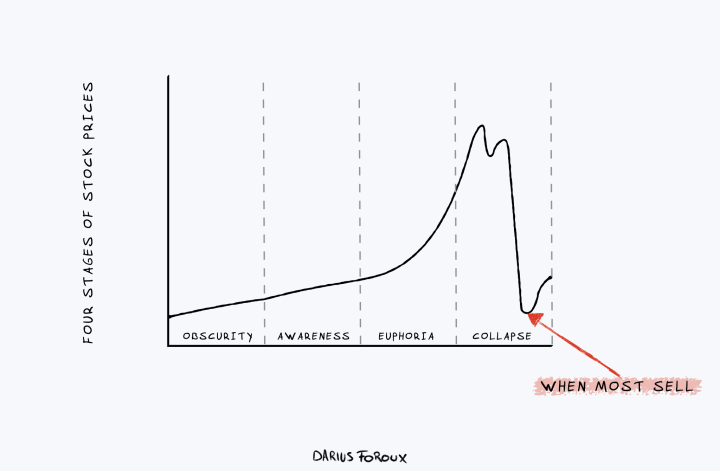

The better strategy is to find opportunities that will grow your income. You can learn marketable skills. Compound your money through investing. And so forth.

3. Have an “extra” $1,000

I mentioned earlier that most Americans can’t afford to pay a $1,000 emergency expense out of pocket. That’s why having an emergency fund — even just a small one — can help secure our stability. Ideally, you’ll have at least 6 months’ worth of expenses safely tucked away in a savings account. But if you’re so far from that, then it’s all about getting started slowly.

You don’t have to build your emergency fund all at once.

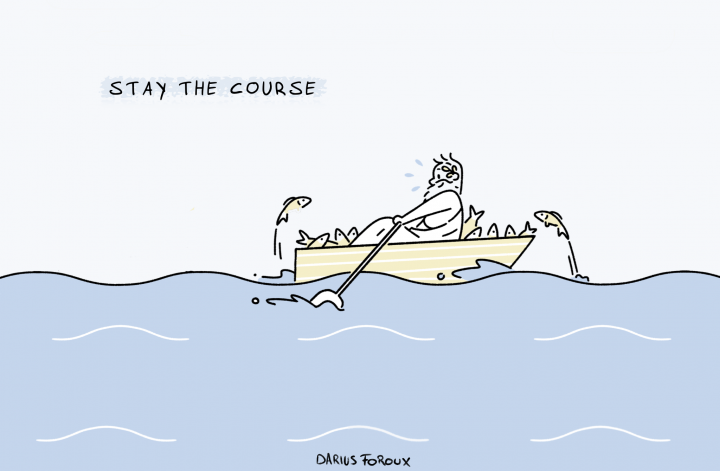

You can start with a smaller goal, like building up $1,000. Then you can gradually increase it from there. That’s how you sustainably build a safety net and become financially stable.

Not having an emergency fund can put our minds into a defensive state. So it’s good to build it up early and not worry too much about it later on.

4. The 3-Account Strategy

I have three bank accounts. I don’t like having only one because it gets difficult to manage finances that way.

So I apply the 3-account strategy:

- The normal checking account — I use this account to cover groceries and other small purchases. My personal rule is to keep only $800 or less. The actual amount depends on your circumstances. The important thing is that this account contains all of your expense money. This prevents you from overspending and making impulse purchases.

- The fixed costs account — Mortgage payments, bills, etc. Everything I pay for regularly, I automatically debit to this account. Having this account gives you a clear view of your cost of living.

- The savings account — Most people spend their income first and pay the bills with the remainder. The result? No savings. I recommend saving the same amount every single month. It’s all about building the habit. And keep everything automatic so you don’t even have to think about it.

5. Think of your freedom

Ideally, the only debt you’d have, if you have any – is your mortgage. Debt from buying consumer goods is very bad debt.

I’ve talked about the best way to pay off debt in this article.

If you have existing debt, allocate a percentage of your income to pay for it regularly without incurring more.

Remember: Money gives you options. Every time you spend, you give up a portion of your freedom. So avoid wasting your freedom on things you don’t need or genuinely want.