So many of us carry around some baggage when it comes to money. Some folks find it rude to talk about finances, others are ashamed or uncomfortable.

And then there are many folks who’re clueless because no one ever taught them how to talk about money.

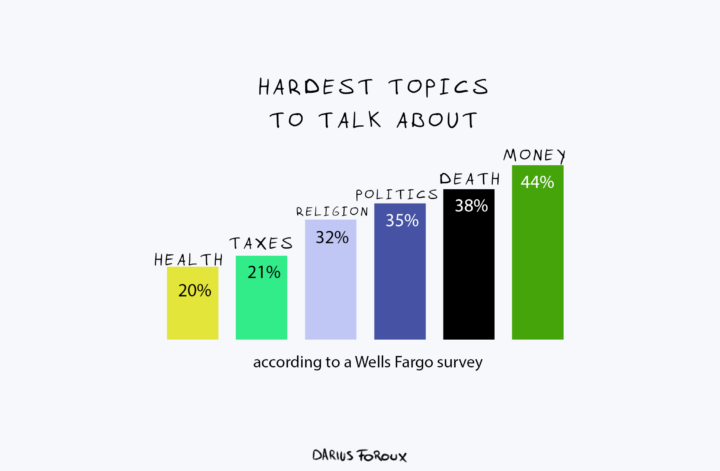

It’s no wonder that a recent survey found that 44 percent of Americans see personal finance as the most challenging topic to discuss with others.1Source: Business Wire Most folks find it harder to talk about money than subjects like death, politics, and religion.

A 2009 study highlighted something interesting: Those who talked about money at home while growing up didn’t struggle as much with impulse buys or maxing out credit cards.2Source: Science Direct In fact, the researchers found that if you’re brave enough to share your financial goals with your friends, you’re more likely to hit them.

Too many people are bogged down with debt.3Source: Scientific American This prevents them from saving, which worsens their finances. And this, in turn, makes them even more embarrassed to talk about money with their loved ones.

Talking to your peers about your financial goals improves your chances of actually executing them.

The science checks out: The odds are higher that you’ll do better financially when you become more comfortable talking about money.4Source: Science Direct If you’re someone who didn’t grow up discussing finances at home, how do you start talking about money now?

1. Know why you’re talking

Before getting into the money talk, ask yourself:

“What do I hope to learn, and why do I think more knowledge about finances would help?”

If you can answer that, chances are the other person will feel less like they’re being interrogated and more like they’re part of a team effort. This also provides more context for the person you’re talking to.

For example, imagine talking to your partner about expenses. You could approach the topic by saying, “I’m actively curbing my spending habits and I’m curious about your approach to budgeting for X. Would you be open to sharing some insights?”

Or, if you’re feeling bold, give this a shot: “Hey, I’m curious about how people handle their income. You seem to have it figured out. Are you open to talking about it more, or does that make you uncomfortable?”

2. Observe how the other person reacts

Check out how the other person reacts when you mention money. If they freeze up, maybe they’re not quite ready yet.

You can’t force someone to talk about money if they’re not into it. If your friends aren’t up for money talks, maybe it’s time to expand your social circle. It doesn’t mean your friends are bad, it just means there are other spaces where these conversations are more welcome.

If your friend seems into the conversation and genuinely interested, it’s a good sign that they’re comfortable discussing money with you. Keep an eye on their body language and tone of voice. These cues can give you a better idea of how open they are to talking about money.

If they let you know that they don’t want to talk about their finances, then it’s best to drop the subject for now. Respect their decision and maybe bring it up later when they’re more open to it.

Remember, not everyone has the same level of financial literacy.

3. Remember that you’re not seeing the whole picture

You’re never getting the full story. That’s just the truth when it comes to humans.

Someone might brag about their fat paycheck but leave out the fact that it’s mostly bonus-based, so their income fluctuates a lot. Or they might be drowning in credit card debt or student loans. You never really know someone’s full financial situation. So there’s no point in comparing or judging yourself (or them) based on the partial truths they share.

Building wealth is hard, but not impossible. That’s why we always need to learn from other people. We can learn what to do and what to avoid.

And even if a financial discussion doesn’t immediately make you wiser with money, talking about it helps.

Do it for yourself and your loved ones

Let’s break the unnecessary taboo on talking about money. The process can bring us some serious benefits. When we have open and honest conversations about our finances, we can learn from each other’s strategies and mistakes. This helps us gain fresh perspectives and take charge of our financial future.

Talking about money can also help us make better financial decisions. By sharing our knowledge and experiences, we don’t have to figure everything out on our own.

Being upfront about money helps remove the negative stigma about wealth and finances that society has.