The ancient philosophy of Stoicism was founded in Athens at around 300 B.C. Stoicism has gained popularity recently because it provides a useful and practical way of viewing life. It can also be used for wealth-building, which forms the principles of Stoic investing.

Being a Stoic makes you better at money, wealth-building, and investing. Stoic Investing strategies teach us to manage our emotions and focus only on things within our control (and let go of those that we cannot).

As the ancient Stoic philosopher Seneca urged:

“You live as if you were destined to live forever, no thought of your frailty ever enters your head, of how much time has already gone by you take no heed. You squander time as if you drew from a full and abundant supply, though all the while that day which you bestow on some person or thing is perhaps your last.”

Stoics acknowledge that time – unlike money – is finite. That’s why a lot of Stoic investing strategies rely on living in the present moment and making time your ally.

How do you apply Stoicism to investing?

Stoicism is about thinking long-term rather than short-term. When applied to investing, it means investing your money now so you won’t have to work as hard in the future.

In the practical sense, Stoic Investing can mean doing the following:

- Invest to build long-term wealth, not to make major purchases — Many people invest with the goal to make a lot of money so they can buy a bigger house, a new car, or to travel more. As a Stoic investor, you shouldn’t look at investing like that. Simply see investing as a way to compound your money so you can buy freedom, not things.

- Only speculate with money you can afford to lose — If you do want to trade stocks for short-term profits, protect the downside. Only make riskier bets with the money you can afford to lose.

- Stay invested even during market downturns — The stock market goes up and down unpredictably. Your job is to invest during it all.

- Invest consistently — The key is to invest a certain percentage of your income every month (10% is a great start). As you earn more, you will also invest more.

What did the ancient Stoics say about money?

We have the “big four” ancient philosophers of Stoicism: Epictetus, Marcus Aurelius, Seneca, and Musonius Rufus. You can learn more about them in my book, The Stoic Path to Wealth.

All four of these philosophers emphasized the importance of living a simple, frugal life and not being overly attached to material possessions.

Epictetus said it well:

“Wealth consists not in having great possessions, but in having few wants.”

However, it is NOT true that the ancient Stoics were averse to money. Instead, they underlined the importance of non-attachment. As Seneca said:

“For the wise man does not consider himself unworthy of any gifts from Fortune’s hands: he does not love wealth but he would rather have it; he does not admit into his heart but into his home; and what wealth is his he does not reject but keeps, wishing it to supply greater scope for him to practice his virtue.”

It takes money to be free, but chasing wealth shouldn’t consume us. The key is finding a balance between financial stability for ourselves and our loved ones, and understanding that true happiness isn’t found in material possessions alone.

As Marcus Aurelius said:

“Greatness lies not in wealth and station, as the vulgar believe, not yet in his intellectual capacity, which is often associated with the meanest moral character… True greatness lies in the consciousness of an honest purpose in life, founded on a just estimate of himself and everything else, on frequent self-examination, and a steady obedience to the rule which he knows to be right.”

Finally, Musonius Rufus reminds us that we shouldn’t be overly focused on our journey to building wealth. Our life and career ambitions can sometimes push us towards the pursuit of money. And that’s okay as long as we remember to not waste our most important asset, which is time. As Rufus said:

“It is not possible to live well today unless you treat it as your last day.”

The ancient Stoics argued that true wealth and contentment come from satisfaction with what one has, rather than always wanting more. The key lies in staying non-attached to material wealth or possessions.

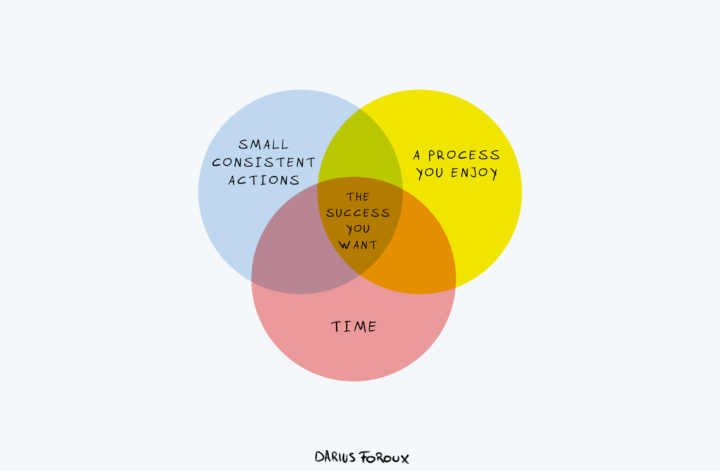

The Stoic Triangle of Wealth

How can you set investment goals with a Stoic approach? I’ve found three strategies to build wealth while still living a fulfilling life.

- Focus on your true desires

- Compound your money

- Protect your capital

I call that the Stoic Triangle of Wealth. This idea allows us to live a life that’s both fulfilling and financially abundant.

Focus on your true desires

Here’s a thought experiment: What would you be doing on an “ideal day”?

Consider your ideal daily activities, from waking up to going to bed. For me, it’s writing, reading, running, cycling, and quality time with loved ones. Do fancy cars and lavish vacations appeal to me? Sure. But, I’m not going to invest significant energy and time chasing them.

Financial freedom means living days without being tied to a job you dislike. Because our desires fall into two categories: What society expects us to want and what we truly desire.

Many of our desires are influenced by external pressure. Some people purchase specific brands to impress, and so forth. Indulging in these isn’t inherently bad, but problems arise when we pursue a life valued by others over what we genuinely want.

Compound your earnings

Building wealth like a Stoic means prioritizing peace of mind. Our time is limited, and we can’t rely on a high-paying job indefinitely. Therefore, finding ways to build wealth outside of work is crucial. Warren Buffett said it best:

“If you don’t find a way to make money while you sleep, you will work until you die.”

Also, everyone needs an emergency fund. If you haven’t started, aim to save a month’s expenses in a savings account, then work up to three, six, and perhaps even a year’s worth. I believe six months is sufficient.

By saving and investing regularly, you’re on the path to financial freedom.

Protect your capital

The famous stock trader, Paul Tudor Jones, said:

“The secret to making money is playing defense. You must protect your capital and resist the urge to make wild bets that have a low probability of success.”

Many investors chase high-risk, high-yield investments without grasping the need to protect their capital. To avoid this, educate yourself on investing basics to safeguard your assets. It’s wiser to gradually build wealth while protecting your money than to risk it all for a get-rich-quick scheme that might cost you your life savings.

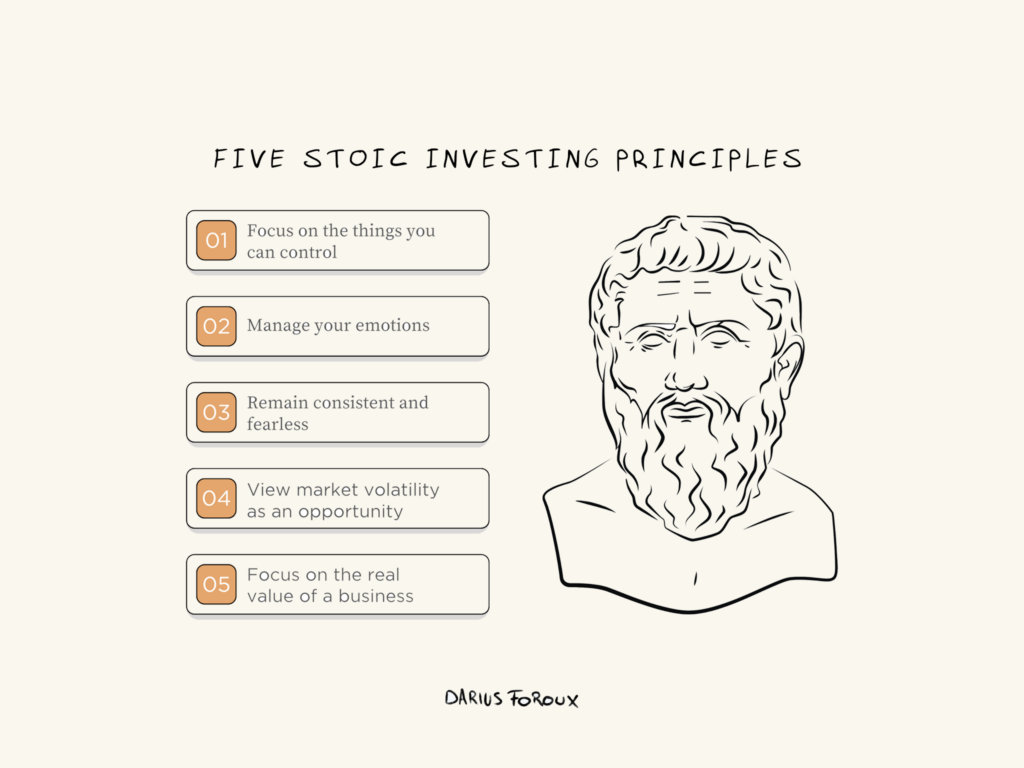

5 Stoic Investing Principles

To better understand Stoic investing, we can look at the following key principles.

1. Focus on the things you can control

In investing, you can’t control everything, like market swings or the economy. Stoic investing tells you to concentrate on what you can control, like your investment plan, how you spread out your assets, and how you manage risk. By focusing on what you can change, you’ll make smarter choices and reduce stress.

2. Manage your emotions

Stoicism teaches the value of staying emotionally strong and not getting too caught up in external events. This approach involves not panicking and selling off investments during market dips or getting swept up in investment fads because of the fear of missing out (FOMO) or the Fear of Better Options (FOBO). Investors who follow Stoicism strive to keep a cool head and make decisions based on long-term goals, not on fleeting emotions.

3. Remain consistent and fearless

Again, Stoicism is about accepting what we can’t control. Stoic investors know that to succeed, you need to be consistent and focus on long-term goals. Adopting a Stoic mindset means staying strong during market ups and downs. This leads us to:

4. View market volatility as an opportunity

Stoic investing is all about accepting that markets will always go up and down. Instead of worrying about drops in the market, Stoic investors see them as chances to buy assets cheaply. They know that these ups and downs are just short-term and that over time, the market trend will eventually keep going up.

5. Focus on the real value of a business

Stoic investors prefer companies they understand and that show real profit and value. They don’t invest in something purely out of hype. When you focus on real value, you make investment choices with an eye on the long-term rather than short-term profit. It’s all about knowing the true worth of an investment and making well-informed decisions.

Living well is the opposite of mindless consumerism

Some time ago, I sold a car I was fond of because I was planning to move abroad. I wondered, why keep the car? Letting go wasn’t easy, but when I handed over the keys, I realized that the car was never truly mine. It reminded me that you can’t lose what you never owned.

The truth is, we don’t really own anything. We’re just passing through, and the things we buy and call “ours” aren’t truly ours.

I’ve always loved the idea of a simple life. There’s something freeing about owning less. It feels liberating not to be burdened by too many possessions.

The real essence of Stoic Investing is to be able to pursue what we truly want and ignore what we don’t. It’s about investing in the things, people, and experiences that actually matter to us.

Order The Stoic Path to Wealth

My new book, The Stoic Path to Wealth (Portfolio / Penguin), is out now.

Learn more here: stoicpathtowealth.com