When it comes to personal finance, one of the most common questions people ask is: How much money should I save?

The answer is not as simple as providing a fixed percentage or amount. Instead, successful saving requires a balanced perspective that considers your current financial situation and future goals.

What is successful saving, really? To me, it’s about two things:

- Putting enough money aside so that your net worth increases every year

- Avoiding saving so much that you deprive yourself

You want to save money, but also not be extreme. Some people think you always save money so you can buy something. But that’s not how I see it. I save money to build wealth. I don’t need to spend that money.

As the Stoic philosopher Seneca once said:

“It is not the man who has too little, but the man who craves more, that is poor.”

The importance of saving

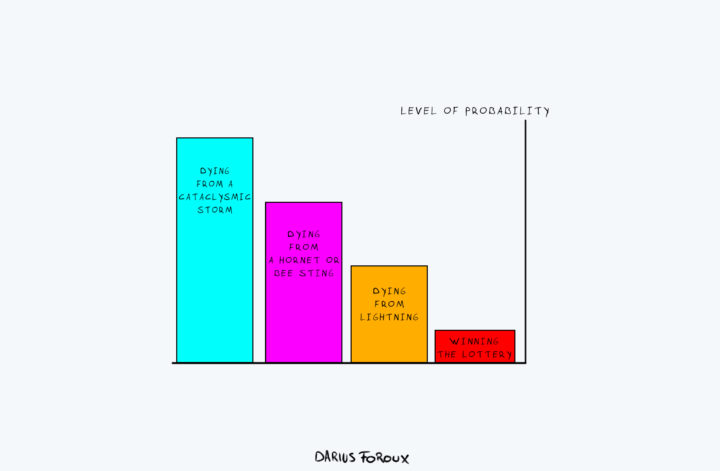

It’s obvious that saving money is essential for creating a stable financial future. By setting aside a portion of your income, you can build an emergency fund, save for big-ticket items like a home or car, and invest in your retirement.

More importantly: Having a healthy savings account also provides peace of mind, as it can help you weather unexpected expenses without going into debt.

However, it’s also important not to become obsessed with saving to the point where it negatively impacts your quality of life.

Striking the right balance between saving and spending is crucial for maintaining a fulfilling lifestyle.

Over-saving and Under-saving

There are two extremes when it comes to saving money: over-saving and under-saving. Over-saving occurs when someone saves so much money that they deprive themselves of experiences and comforts that could enhance their life.

While it’s good to be financially responsible, it’s also important to enjoy life and make memories along the way.

Under-saving, on the other hand, is when someone doesn’t save enough money to cover their future needs.

This can lead to financial stress, debt, and a lack of funds for important life events like buying a home, starting a family, or retiring comfortably.

Finding the Right Balance: A Dynamic Savings Rate

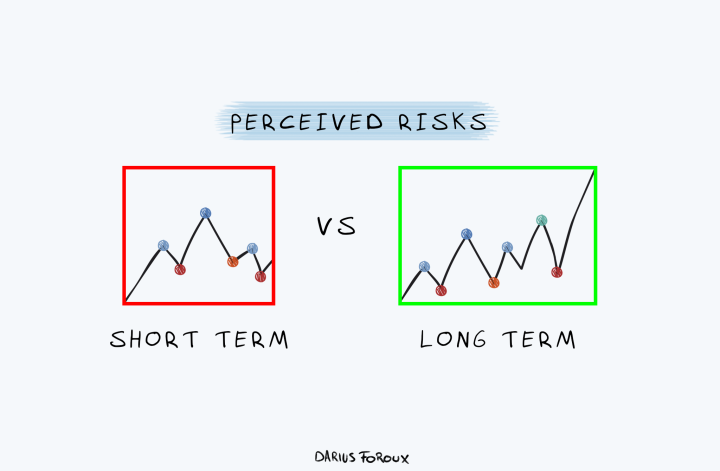

The key to striking a balance between over-saving and under-saving is to adjust your savings rate based on your current situation and goals.

A general rule of thumb is to save at least 10% of your income throughout your entire life.

This will help you build a solid financial foundation and ensure that you’re prepared for the future.

However, there are times when you may want to increase your savings rate.

For example, if you don’t have large expenses or children, save 30% of your income. This will help you to reach your financial goals faster and provide a buffer in case your circumstances change.

When determining your ideal savings rate, consider factors such as your age, income, debt, and financial goals. This is a highly personal topic.

This is why you can’t just adopt the same savings rates as other people.

By following the ancient wisdom of Seneca and striving for balance and contentment, you can avoid the pitfalls of over-saving and under-saving.

Remember to keep your savings rate dynamic, adjusting it based on your current situation and goals. You’ll be prepared for whatever life throws at you without sacrificing the joys of the present.