I was talking to a friend recently who feels like he’s stuck in his job for the past five years. He’s been procrastinating his decision to find something else for a long time.

Every time I ask him about when he actually wants to leave, he always has a reason (aka an excuse):

- “I’m waiting for a bonus”

- “I need to save up more money first”

- “I just don’t have enough time to job search right now”

Sound familiar?

It’s natural for humans to put off major life goals. Whether it’s changing jobs, starting your own business, or negotiating a higher salary, it can be easy to make excuses and procrastinate.

Doing those things is hard. It takes a lot of courage and skills.

But the truth is, you’re putting your financial growth and life on hold when you put things off. You miss out on opportunities that could have changed your life for the better and helped you earn more.

So how do you start taking action? Here are four steps.

1. Stop procrastinating on getting your finances in order

You need to know your numbers. If you want to earn more, you need to take the time to crunch your numbers: How much are you earning? How much are you spending?

The key is to keep it simple.

- If tracking your real-time expenses is helpful for you, then use expense-tracking apps.

- For peace of mind, ensure that you have an emergency fund. If you don’t have one yet, then make it a priority to start building it.

- Set clear financial goals for the short and long term.

You can also apply the 50/30/20 budgeting rule: spend 50% of your income on needs, 30% on wants, and save or use 20% for paying off debt. And keep everything automated so you don’t have to think about it.

When you know your numbers, you can easily see where your money is going. Life circumstances can change quickly, so it’s important to adapt your finances accordingly.

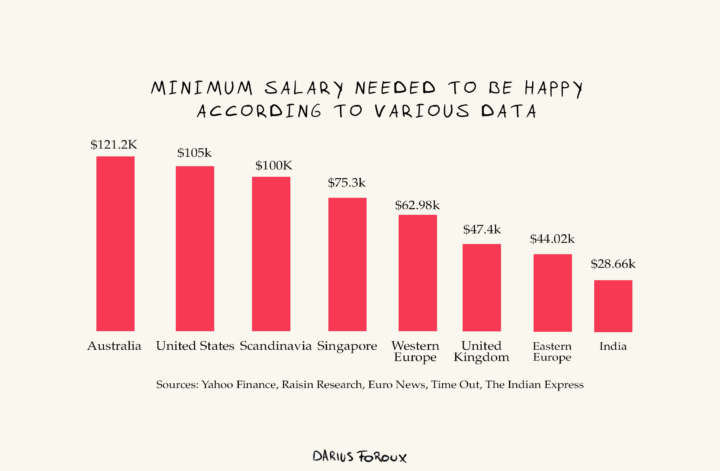

2. Define what “earning more” means to you

Once you have a clear understanding of your finances, set specific and realistic goals.

Instead of saying, “I want to earn more,” define what “more” means. Is it an additional $10K a year? A promotion to a higher managerial role? By setting these specific targets, you create a clear path forward.

Seneca said it well:

“If a man knows not to which port he sails, no wind is favorable.”

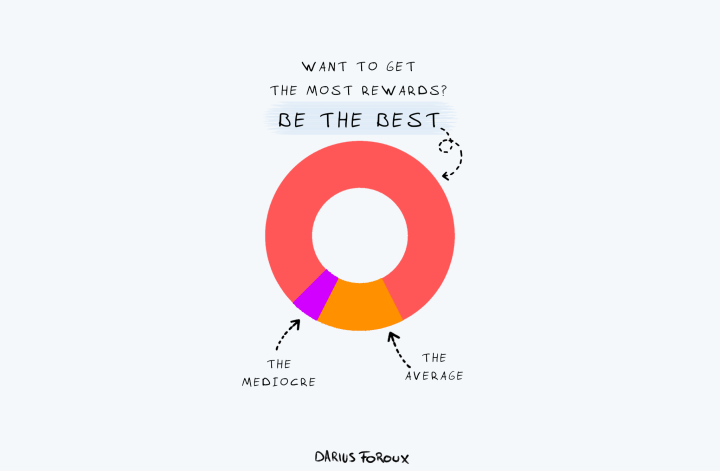

Wealth is built by providing a highly valuable service or product. So if you want to become wealthy, you need to provide a highly valued item or service to others. This could mean developing a new skill, improving your current skills, or finding a niche market to tap into.

The key is to constantly learn and adapt.

3. Get out of your bubble

Unless it’s purely luck, earning more requires personal growth. If you want to grow your income, you also have to grow more as a person.

And growth sometimes requires stepping out of your comfort zone.

- Don’t like your work environment, but you like your field/industry? Look for a better employer. But better employers also need better employees. So you’ll likely need to upskill before getting in.

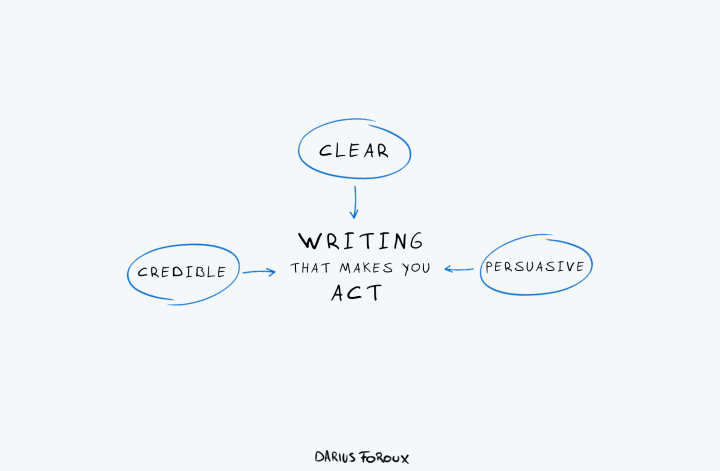

- Want to present an innovative idea to your boss, but you’re not confident enough in your persuasion or presentation skills? Then do the work. There are courses and tutorials that can help you improve. You can even practice with friends. Whether or not your idea is eventually taken in, the important thing is that you did your presentation well and gained new skills.

- Launching a side hustle? This requires overcoming a learning curve. It would be great if all side hustles could start earning sustainable income within 6 months. But if things were that easy, most people would now be financially free. These things take time.

Too many people are stuck in their old situations because they don’t want to get out of their comfort zone. By taking on new challenges and learning new skills, we open ourselves up to better opportunities.

4. Find a mentor

Having a mentor can provide you with guidance, support, and insider knowledge about your industry. Mentors can help you navigate career challenges, provide feedback on your goals, and keep you accountable.

Your “mentor” doesn’t need to be a famous person who is personally coaching you. That would be ideal, but successful people get mentorship requests all the time. If you can write a good pitch email to a mentor, and they respond positively, then that’s great.

But if not, you can always use them as models instead. The key is to find two or three people who have achieved what you want and are living the lifestyle that you like.

Study how they forged their path. What were their attitudes, beliefs, and habits?

You’ll probably find that they all share some similarities in how they approach work and life. You can use these as guidance.

Act or regret

The key is to get started.

Don’t wait for opportunities to come to you. Take the initiative and make it happen.

If you’re procrastinating your income goals, you’re not alone. Many people struggle with taking action towards their financial goals. Simply start small and build momentum.

Too many folks are not financially free because they procrastinate for too long on their income goals.

It’s natural to find yourself making excuses; the fear of failure or the discomfort of stepping out of your comfort zone can be daunting.

But delaying these will only turn into regret. The longer you wait, the more opportunities you’re likely going to miss.

So take the first steps. No matter how small. And take it now.