To build wealth, we can do two things:

- Earn more money

- Spend less than we earn

Option 1 is great but takes time and is somewhat out of your hands. You can work really hard and still end up not making money.

Option 2 is perfect because it’s more within your control. And yet, there are a lot of folks who don’t save enough.

Saving and investing are just like keeping fit. When the process feels like you’re “depriving” yourself of something, you’re more likely to splurge and waste your efforts later. That’s why you need a way to spend less without making it “hurt.”

Here are 5 things you can do to make the process of spending less easier and more sustainable.

1. Live in a cheaper city

Where you live impacts your lifestyle and expenses. And in big cities, you usually have an expensive lifestyle and high expenses, which makes it hard to build wealth.

I personally don’t know anyone who became rich by living in a big city. All the wealthy folks I know live in more affordable cities and places. They don’t live in downtown Amsterdam or Manhattan.

If you’re one of those folks who can’t leave the big city, ask yourself:

“Is financial stability a main priority in the next 5 years?”

If the answer is no, because you have priorities higher than financial stability — at least for now — then go for it.

This can work if you’re pursuing a goal that can only be achieved by staying in the big city, like if your business or client pool is exclusive to that area. Or you’re attending a dream company or prestigious university there, etc.

But if ego or peer pressure are the main drivers of your stay, then I recommend getting out as soon as you can.

With the nature of remote work, you can build a good career without living in big cities.

2. Make eating at home very easy

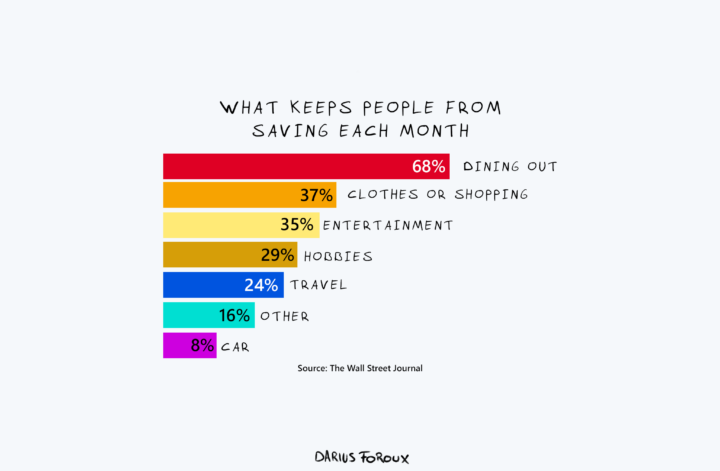

People who dine out a lot usually don’t realize how much they’re really spending. This is also true for folks who don’t dine out but rely too much on take-outs because they don’t cook at home.

The thing is, it’s not just the money you spend dining out that affects your finances. It’s also the habit you develop.

In a study, researchers found that people who dined out frequently tended to underestimate the amount they would spend during a week of eating out and then raise the following week’s dining-out budget. The researchers said:1Source: PSU

“What we saw consistently throughout the study was that when people reported their dining-out budget for the second time during the experiment, it was significantly higher than what they stated the first time…

What this tells us is that, obviously, they [the people who dine out often] thought they would spend less in a week, but as the week progressed they realized they were spending a lot more and they rationalized that increase.”

This rationalization of increased expenses is what really hits your finances in the long run. You get into the habit of spending more. Then it applies to your other spending habits. Eventually, these add up.

3. Find a sustainable “feel good” habit

People get a dopamine rush when they spend. Especially when it comes to shopping. Stanford researchers found that when you see pictures of things you want to buy, your dopamine receptors go active.2Source: NCBI

That’s why it’s so easy to fall into the trap of impulse buying.

How do you prevent that? Find an alternative switch for your dopamine receptors.

My researcher, John, once told me about a weekend he spent at a friend’s house in a rural part of town. He and his friend spent most of their time going on 4-6 hour runs, playing sports with other friends nearby, and playing video games.

Since John’s friend kept a strict diet due to health concerns, they stuck to home-cooked meals that were mostly sourced from the friend’s small vegetable garden.

The result? They didn’t spend anything that weekend. And they still enjoyed their time.

John also noticed that he didn’t crave the usual things he’d spend on during weekends, like coffee or eating out. He was too engrossed in his activities.

We don’t have to live in rural places or eat homegrown produce to save money. Just don’t spend when you’re bored. I’ve known people who scroll shopping sites out of boredom. That’s a habit that quickly leads to financial ruin.

Instead, do things you enjoy that don’t require a lot of money. Like working out, going on long runs, hanging out with friends, etc.

You don’t need to spend every time to get a dopamine boost.

4. Never buy something “small” unless you planned to have it in the first place

Every shop is designed to upsell you.

Fast food employees are trained to ask, “Would you like to add X to that order?” Groceries strategically place candies and treats at the counter because they’re “cheap” and easy to include in your cart.

Various products come with additional “freebies” if you spend a few dollars above the original price.

These small purchases add up. So you can easily spend more than you intended to. The solution? Make it a habit to say “no” whenever businesses offer you anything that increases your original buying price.

If you change your mind later, you can simply go back.

But aside from the money spent, it’s important to build the habit of buying only what you set out to buy. Once this habit is built, you can drastically avoid overspending.

5. Keep your finances realistic

Some time ago, I was talking to someone who told me their plan for financial freedom was to build a business, invest their money, make a million bucks, and then buy a Rolls Royce in 2 years.

The chance of a person going from median income to the top 0.1% income is a big leap. And it’s unlikely to happen in 2 years or even 5. Big goals like that take time and luck.

So instead, try asking yourself: “How much can I really earn? And what lifestyle can this afford me?”

We don’t want to coddle ourselves. We have to understand what kind of lifestyle we really want based on our present means.

By being truly aware of your needs and wants, you can set realistic financial goals. This helps you execute a spending and earning strategy that works well for your situation.