In 1891, a thirteen-year-old boy from Acton, Massachusetts decided he wanted to escape country life. His father ordered him to quit school and work on the farm. But he didn’t want that.

He was a frail boy, good with numbers and equipped with a bright mind. He’d learned to read by age three and a half, and he devoured every reading material he could get his hands on. He couldn’t stand the thought of spending the rest of his life doing manual labor. He wanted to use his mind to earn a living.

Growing up, he read about Paine Webber, a Boston-based stockbroker. He read the old newspapers strewn around their house and learned that the financial world thrived in Boston. So he wanted to go there.

Eventually, the boy asked his mother for help and they forged a plan for him to escape to Boston.

His mother knew her husband wouldn’t budge and allow the boy to stay in school. It was painful for her, but she helped her son escape.

When his mother helped him escape in July of 1891, all he had was five dollars and an address of his mother’s friend where he could stay.

But the boy was dead-set on getting a job before getting a place to stay. So his first stop was Paine Webber, where he secured a job as a “board boy,” writing stock prices on a blackboard by hand.

The boy’s name was Jesse Livermore, who would become the greatest stock trader of all time. In 1907, he famously made $1 million in a single day, a feat that no one had accomplished before. He went on to make (and lose) several fortunes.

Discipline, patience, and knowledge

I’m currently profiling Jesse Livermore for my next book, The Stoic Path to Wealth. He was a highly dedicated and disciplined person, who put all his energy into trading stocks.

He started at age fourteen and worked six days a week for a decade before he started consistently generating money from stocks. In a biography about Livermore, “Boy Plunger,” the author Tom Rubython shares a quote from Livermore that demonstrates his mindset:

“I had learned that I had to work for my money. I was no longer betting blindly or concerned with mastering the technique of the game, but with earning my successes by hard study and clear thinking.”

This is a common theme that I’ve noticed in Livermore’s life. The man was incredibly lucky with some of his investments. But he also worked incredibly hard. Here are three lessons I’ve learned from Livermore.

1. Discipline is key

In life, there’s often a lot of room for making mistakes. When you make a typo in your writing, the reader still understands you. And you can easily fix a typo. When you play sports, you can make multiple mistakes in a game and still win.

But when you invest, making several mistakes in a row can wipe out all your money. Discipline will help you to stick to your investing strategy, which is more important than what your strategy actually is.

Remember: A disciplined investor with a mediocre strategy builds more wealth than an undisciplined investor with an extraordinary strategy.

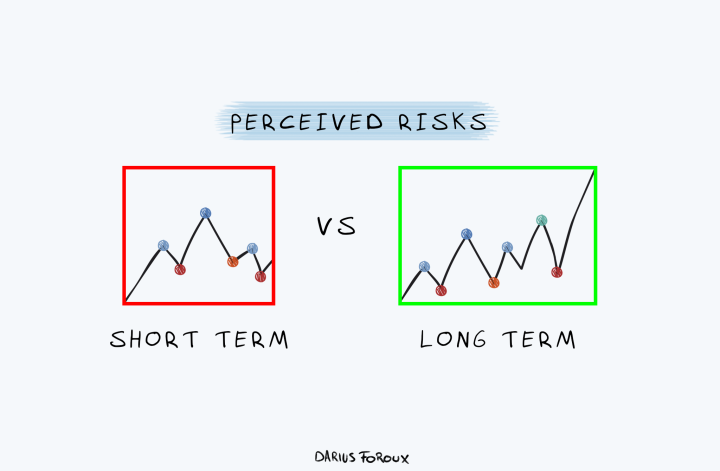

When you put your money on the line, you always feel fear and greed at many different moments. An undisciplined investor might pull out all their money on the first sign of a stock market correction.

But if you’re disciplined and you’re investing for the long-term, you will stay put. And doing nothing is one of the most difficult things when your money is in the stock market.

2. Building wealth takes time, so be patient

In behavioral economics, there’s a concept called “present bias.” It refers to our tendency of giving more importance to payoffs that are closer to the present time than considering a trade-off between two future moments.

Waiting for a pay-off goes against our nature. On top of that, we’re generally really bad at placing value on rewards at different points in time.

What’s better? $100 in a year from now? Or $120 in thirteen months from now? Most people pick the latter. Waiting an extra month for more money isn’t a big deal when you already waited a year. But when we change the time-frames, things change.

What if you can choose between $100 now or $120 in a year? Most people will go for the $100 now.

But a successful investor usually takes the option that has a high probability of giving you a good return. It doesn’t matter what the dollar value is. What matters is that there’s a 20% return in that example.

When you train yourself to go for the highest rate of return, you learn you always have to wait for the best return. Hence, you automatically become patient.

3. Having basic knowledge about the financial world makes you more confident

While most people know Jesse Livermore as a proponent of technical analysis, he had an excellent knack for the fundamentals of business and economy. From an early age, he was a student of the financial world.

Livermore learned to read and write by age three and a half, and he read everything he could get his hands on. His mother brought him old newspapers, where the young Livermore first learned about stocks on the financial pages.

When you learn more about the economy, business, and finance, you feel more confident about investing. You will learn that the stock market is hundreds of years old and that investors are getting more professional every decade.

Our financial system is a true machine that most people only view from the outside. Take a look under the hood by reading books, articles, and newspapers to learn more. It will not only improve your returns, but it will make you confident enough in the economy to put your money on the line.

If building wealth was easy, everybody would be rich

The main lesson I learned is that building serious wealth requires serious decisions. This is something most people don’t stress enough.

As Livermore often remarked, you need discipline, patience, and knowledge.

Whether you’re a short-term speculator or a long-term investor, you need to do hard things to become wealthy. It starts with earning money and making your way through your life and career.

Livermore worked as a board boy for years and saved almost every penny he earned. After several years, he started buying and selling stocks. Before making money with stocks, he solely saved money and learned more about how the financial world worked.

Building wealth takes time. When you try to chase get-rich-quick opportunities, you often learn the hard way that money doesn’t come for free.

But when you adopt a long-term view and keep learning, keep investing, and keep making progress, you’ll likely end up with way more money than you ever thought possible.