About six months before my dentist died in a motorcycle accident, he gave me some of the best advice I’ve ever received.

I’ve been going to the same dentist all my life, so we knew each other well. Every time I went to him for a checkup, we talked more than he spent time checking my teeth.

In recent years, we’ve been talking more and more about investing and wealth. He didn’t only have his dental practice, he also did well in the stock market.

He started investing in his thirties and acquired substantial wealth in his life. He was only 57 years old when he passed. Here’s the advice he shared with me (as I remember it):

“Don’t worry too much about saving so much money at your age. I know you want to be financially independent. But you have your best earning years ahead of you. In general, your best earning years are often in your 40s and 50s. So why too much now? When you earn more later, you’ll be able to save and invest more. It’s good to start and learn now. But you don’t have to save all your money. Enjoy your life.”

The man truly practiced what he preached. He took a two-year sabbatical when his kids were very young. They traveled the world and spent a lot of time sailing. He owned a restaurant. He collected vintage Citroën cars. The guy lived a good life.

There is a point you’re saving too much

My dentist challenged me to think about the concept of enough. Just like you can have enough wealth, there’s also such a thing as saving enough, regardless of how much you’re earning.

I’ve seen this first-hand with some of my family members who are now in their fifties. They saved so much in their 30s and 40s that they didn’t do a lot of things they wanted. Now, they realize they’re getting older and that they might’ve been too extreme with their saving strategy.

This is the biggest mistake people who strive for financial independence make. I’ve encountered several people who are obsessed with early retirement. They deprive themselves so much in the present that they’re living purely for the future.

Some people save up to 70% of their income. Now, I don’t mind going extreme for a few years to build up some cash to invest. But the danger is that it becomes habitual.

I also like the book that popularized early retirement, Your Money or Your Life, but I interpret it differently. To me, the key is simply to be more conscious of how I spend my money. I don’t like to calculate everything to the penny and worry about my current financial situation.

I know I will keep earning money. When you’ve invested in marketable skills, you’ll be capable of providing value. And people pay good money for value. This compounds as we get older, get better at what we do, and grow in our careers.

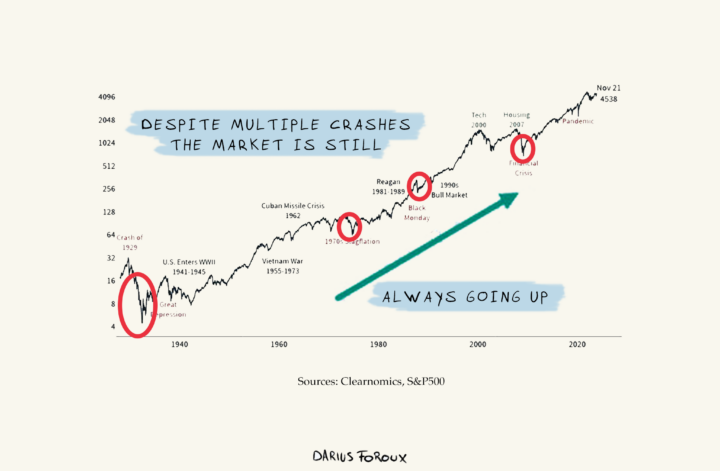

As my dentist said, you’ll probably earn more when you’re older. That’s the normal progress for most people who invest in themselves.

If you’re 30 and you worry about your financial future, you tend to look at a very short time frame. You look at your recent earnings history and what you’re earning now, and you can’t see how you can earn more in the future.

So what do you do? You work with what you have. You try to save more because it gives you a sense of control. You don’t like uncertainty, so you try to avoid it by saving more.

When are you saving too much?

Here’s how to figure out if you’re saving too much. Are you asking this every single day: “How much is that?” That’s a common and compulsive thought pattern of people who save too much.

They are constantly obsessed with what the price is for everything and how it affects their savings. This is not healthy behavior.

On the other hand, if someone is spending all their money and living check to check, it’s also not good. The balance is somewhere in the middle.

The lesson here is that there are no guidelines or rules. It’s simply impossible to subscribe to rules like, “You need 1 million dollars. And you need to withdraw 4% every year to be independent.”

That’s too black and white. Life is so complex that we need to analyze our own situation.

There are many factors that play a role. How old are you? What do you value in life? What type of lifestyle do you want? Do you have a career you enjoy? Where do you live? What are the odds you can do your work until you’re old? Do you have a support system?

Take your time to think about these things. Figure out your strategy. Something that makes sense for you. If you need help with that, I recommend hiring a financial advisor who shares the same values as you.

But no matter what you do, keep in mind that you’re always living in the present. Avoid living in the future. You risk missing out on today—which is the most important thing you have.