Warren Buffett, the ‘Oracle of Omaha,’ one of the most successful experts at picking stocks, famously started investing at the age of 11.1Source: CNBC

He bought his first shares for $38 apiece. He is now worth $133 billion in 2024.2Source: Forbes

This level of success can only happen if you have a system for success. Investing in public equities is not like gambling. There is a thought process behind picking stocks.

But Buffett’s approach isn’t about complex financial metrics or short-term gains.

Instead, it revolves around a simple but practical idea: Finding companies that have the potential to dominate their respective markets over a long period.

Here’s what Buffett said:

“I look for businesses in which I think I can predict what they’re going to look like in ten to fifteen years time. Take Wrigley’s chewing gum. I don’t think the internet is going to change how people chew gum.”

Let’s explore this philosophy through three of his significant investments – Geico, Coca Cola, and Apple.

Betting on insurance: Geico

Buffett began buying shares in Geico back in 1951 when he discovered that his mentor and Columbia University professor, Benjamin Graham, was the chairman.

Intrigued by the company’s business model of direct selling, which cut costs and increased profits, he initially invested $10,282. He sold his stocks a year later for $15,259. However, he later regarded this sale as a mistake, realizing that if he had held onto the investment, it would have grown significantly more.3Source: EB

Buffett began buying significant amounts of GEICO stock again in the late 1970s when they were facing financial difficulties. By 1976, he had invested $23.5 million, which laid the foundation for a larger stake in the company.4Source: The Motley Fool He sometimes talks about this when he speaks to younger would-be investors.5Source: CNBC

“My favorite investment, one that embodies this philosophy, is Geico, which I learned about when I was 20 years old,” he advised

Buffett recognized GEICO’s strong business model and market potential, which was initially based on serving government employees.

Over the years, Berkshire Hathaway continued to increase its stake in GEICO. Throughout the 1980s, Berkshire Hathaway owned approximately 50% of GEICO and eventually purchased the remaining shares for $2.3 billion, at the end of 1995, making GEICO a wholly-owned subsidiary of Berkshire Hathaway.

The key takeaway here? Buffett recognized Geico’s solid business model and saw its potential to disrupt the insurance industry. He was not afraid to invest in the company when its stock was down during the 70s. He was confident he was picking the right stocks.

Investing in what he drinks daily: Coca-Cola

Buffett started Berkshire Hathaway’s position in Coca-Cola in 1988 and 1989, purchasing 23 million shares at an average price of $43.81 per share, which was about $2.73 on a split-adjusted basis.6Source: The Motley Fool

This move was made when the stock was still recovering from the 1987 market crash, and it reflected Buffett’s ability to identify value in the midst of uncertainty. He recognized Coca-Cola’s potential for growth, not just as a beverage company but as a global brand that could leverage its market position to expand further.

And most importantly: Buffett himself was Coke’s biggest fan. This is something that investing legend, Peter Lynch, also recommends doing: Buy a company you actually know.

There were several key factors that influenced Buffett’s decision to invest heavily in Coca-Cola:

- Undervaluation: When purchased, Coca-Cola’s stock traded at 15 times its 1988 EPS. Buffett saw it as undervalued given its growth potential, despite not being a deep value stock.

- Strong Brand and Market Dominance: Coca-Cola remains one of the most recognizable brands globally, sold in over 200 countries and leading in non-alcoholic, ready-to-drink beverages. This global reach and brand strength attracted Buffett.

- Consistent Growth and Dividends: Coca-Cola has shown steady growth, with a market cap that has risen significantly since Buffett’s investment. The company also pays regular quarterly dividends, boosting the total return on Berkshire Hathaway’s investment.

- Share Buybacks: Coca-Cola’s decision to repurchase its own shares was another factor that likely appealed to Buffett. The company announced in 1987 that it would repurchase up to 10.6% of its shares over the following three years. Since then, Coca-Cola has reduced its share count by 30%, enhancing shareholder value.

Buffett’s investment in Coca-Cola through Berkshire Hathaway is the perfect example of his investment philosophy, which emphasizes long-term value, brand strength, and company fundamentals.

Better late than never: Apple

Berkshire Hathaway’s initial stake in Apple was acquired for approximately $36 billion between 2016 and 2018.7Source: Business Insider By the end of 2023, Apple was a substantial portion of Berkshire’s portfolio, accounting for nearly 40% of its total equity holdings.8Source: YahooFinance

By the end of the first quarter of 2024, Berkshire trimmed its position in Apple, because it simply became too big. By 2024, this investment still had yielded a considerable return.

Warren Buffett’s decision to start investing in Apple through Berkshire Hathaway was influenced by several key factors:

- Apple’s Ecosystem and Consumer Loyalty: Buffett recognized Apple’s ability to create a comprehensive ecosystem of products and services. Apple users become integrated into the ecosystem and it gets harder for them to switch to competitors.9Source: Forbes

- Financial Strength and Market Position: Apple’s strong financial health, marked by solid cash flows, strong pricing power, and significant sales, was key. Its finances showed the ability to generate consistent revenue and profit, meeting Buffett’s criteria for stable and growing earnings.

- Brand Strength and Market Dominance: Apple’s strong brand and market dominance are crucial factors that Buffett seeks in investments.

While Buffett was late to the tech investment party, he still profited substantially from picking Apple stocks. This is the perfect example of taking your time. Even if you are late to a certain economic trend, you can still profit from it.

6 tips for picking stocks like Buffett

Warren Buffett’s investment strategy has made him one of the wealthiest people in the world. Here are seven tips I picked up from studying Buffett’s approach:

- Understand the Business: Buffett only invests in companies that he thoroughly understands. This includes knowing the company’s business model, industry, competitors, and growth potential.

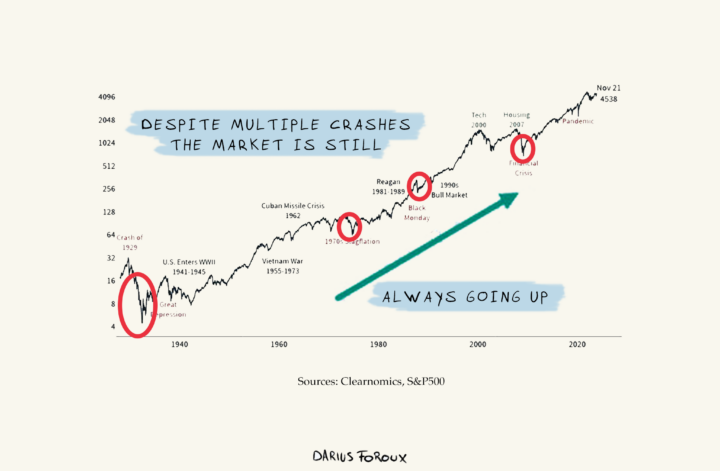

- Be a Long-Term Investor: When Buffett buys shares in a company, he isn’t thinking about selling them in a few months or years. He’s thinking in terms of decades. Patience pays off in the stock market.

- Ignore the Noise: Buffett doesn’t base his investment decisions on the latest news headlines or market trends. Instead, he focuses on the robustness of the companies he’s interested in.

- Stick to Your Circle of Competence: Buffett advises investing in industries and companies you’re familiar with. This way, you’ll be better equipped to make informed investment decisions.

- Look for Companies with a Competitive Advantage: Also known as a ‘moat,’ this could be anything from a strong brand name to a unique technology that protects the company from competition.

- Be Fearful When Others Are Greedy: This classic Buffett quote underscores his contrarian approach to investing. He often finds his best investment opportunities when others are too scared to invest.

Try to remember that successful investing isn’t about making fast money by picking stocks. It’s about making informed decisions and being patient. Because that’s the only thing you control.

Only pick stocks if you’re willing to spend lots of time studying your investments

Buffett’s investment strategy is about understanding the essence of a business, its market position, and its potential for long-term dominance.

In my experience, you can only succeed at picking individual stocks if you’re a complete investing nut. You have to be obsessed with stocks, finance, the economy, and reading about the companies you want to invest in.

If you’re not, that’s perfectly okay.

Not everyone has to be a stock market guru or spend all their time reading financial reports and picking stocks to achieve their financial goals.

There are other paths to financial success and well-being.

You can focus on earning and saving, investing in mutual funds or ETFs, or even hiring a financial advisor. The key is to choose a strategy that aligns with your interests, lifestyle, and financial goals.

Investing is not just about making money; it’s also about peace of mind and having a long-term view. And try not to forget to enjoy life along the way.