The way you treat your money is a result of the habits you have. This is what sets financially responsible people apart from others. And I’m not only talking about the habit of spending.

If you’ve tried to change your spending in the past and failed, I’m not surprised.

Being financially fit and responsible is a lifestyle. It’s not just about what you do with your money. People who are financially responsible are…

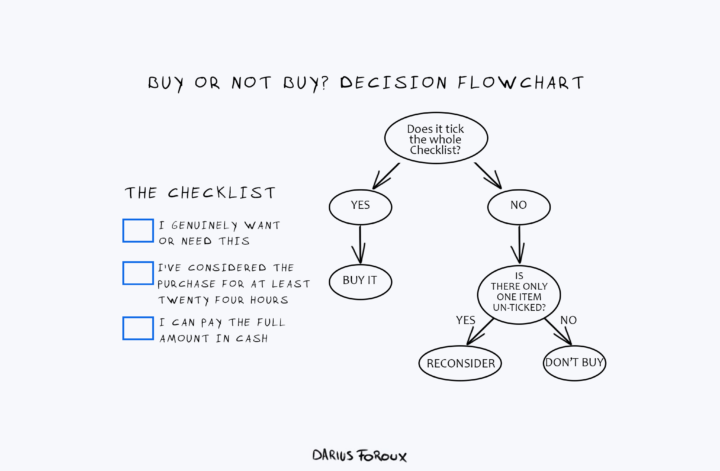

- Intentional with their spending

- Inwardly focused and enjoy the small things

- Saving money diligently every single month

- Spend less than they earn

It’s about how you live your entire life. The good news is that you have the power to change your life.

Simply change your habits. People often say it’s difficult to change because they just can’t help but fall back on their old habits.

That’s true. And that’s not the only challenge. Especially when it comes to our finances, we have to go against our nature. Think about it. Saving for the future doesn’t make sense from an evolutionary point of view.

But as the French philosopher Blaise Pascal said:

“Habit is a second nature that destroys the first.”

What follows is a list of habits I believe will replace our destructive first nature when it comes to money.

1. Meditating

Daily meditation is truly a life-changing thing. The reason we meditate is that we want to distance ourselves from our thoughts.

We want to stop mental suffering. We want to have inner peace and avoid money stress.

When you meditate, you accomplish those things in time. And when you have that inner peace, you will no longer feel the urge to keep spending your money.

This is something I’ve experienced so often in my life. And to be honest, I occasionally still feel it when I’m restless or not present.

During those moments, I feel this internal force to find something I can buy. That could be anything, from a new smartphone to a vacation. I just want to spend.

I don’t know exactly where that feeling comes from, but the good news is that you don’t need to explain your urges. You just need to observe them until they go away.

Remember that every urge or feeling that arises in your system also will disappear. Nothing is permanent. When you meditate, you learn that quickly.

I apply this technique to my money decisions all the time. I always observe my thoughts before I act on them. 9 times out of 10 the thoughts are BS and I just ignore them.

2. Reading

People who read books tend to be calmer and have the ability to focus on one thing for long periods of time.

Reading is also an inexpensive hobby. Sure, it costs money to buy books, but you can also go to the library or read online.

I always enjoyed reading, but when I became a serious reader, I just became calmer overall. Instead of going out and buying stuff, I thoroughly enjoy reading a book.

When you read more, you have less time and energy to be irresponsible with your money.

3. Exercising

Exercise is not only good for your health, but it’s also good for your brain. When you exercise, you generally have more energy and are in a better mood.

And when I’m in a better mood, I’m always more responsible with my money.

As you can see from the habits on this list until now, they have nothing to do with money itself. I’m not talking about tracking your expenses or living on a budget.

I’m not that type of personal finance writer.

Money is an emotional topic. You can’t become more financially responsible if you simply have healthy money habits. You must change your entire lifestyle.

It comes down to discipline. If you’re disciplined with everything else in your life, I guarantee you will be disciplined with your money too.

4. Simplifying Everything

I see keeping things simple as a habit. No matter what you do in life, you can do it in a simple way. Always ask yourself:

“How can I do this activity or accomplish this goal by expending the least amount of energy?”

You’ll find that you have to do it in the simplest way. Take exercising. If you subscribe to highly intense and complex routines, you probably will quit.

At least, I did every time I did something complex. Last year I started a training routine used by triathletes.

I wanted to see what the training for a triathlon was like before I committed to one. I signed up with a coach who made an entire plan for me, consisting of different types of workouts.

The guy meant well, but he made the plan too complex. I had enough after two weeks and stopped working with him. I came back to my simple workout routine for now.

Two full-body workouts a week, two runs, and one long bike ride.

I apply this line of thinking to everything I do, from my work, hobbies, health, travel, and everything else.

5. Being Proactive

Don’t just sit there, do something! That’s the mentality of a proactive person.

When you take matters into your own hands, you will feel more in control of your life. This is the key when it comes to your finances.

When you’re in debt, you need to take action. You sit down, look at your finances, think of how you can cut your spending, and immediately take action.

Even when you’re not in a tough financial spot, you still occasionally look at your spending to make sure you’re not getting out of control.

Life is about balance. You don’t want to become an over-spender but you also don’t become an under-spender (or a cheapskate).

Remain proactive in your life. If you had a great summer and splurged on everything, from restaurants to hotels to new gadgets, take a step back.

Live simply for a few months and save as much as you can. Life is dynamic.

Financially responsible people understand that like no one else. They do what it takes to remain in control of their money.