Fear is a powerful emotion. That’s why we can’t get enough of people who say the stock market will crash.

Fear is often used as a manipulation tool by charlatans, those folks who like to scare people into buying their products or services. Fear can be a particularly effective tactic when it comes to the stock market.

While there may be legitimate reasons to be cautious about investing in the stock market, blindly following someone who claims they know exactly when and why it will crash is not a wise decision.

In fact, these charlatans often have ulterior motives for spreading fear-mongering messages.

Let me share three common fear-based techniques so you can guard yourself against them.

1. “The stock market will crash!!!”

This is a classic technique that seems to never go out of style. Certain individuals will warn you of an impending market crash.

Their solution? Give them your money, and they’ll “protect” you by investing it in their supposedly safe and secure alternatives.

But here’s the thing: The stock market has its ups and downs.

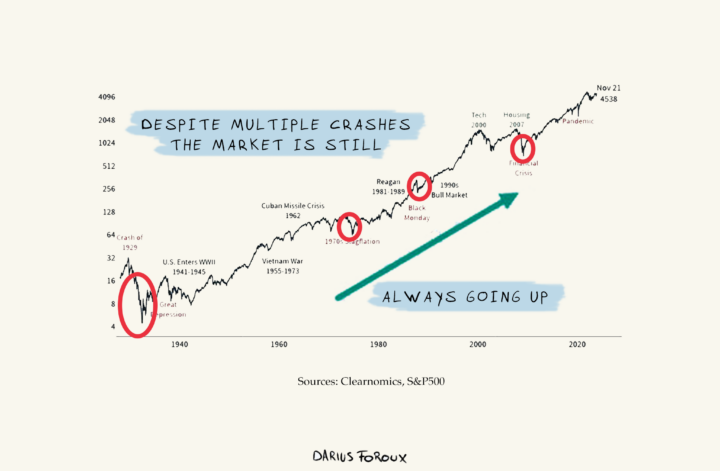

That’s just the nature of the beast. Yes, there are crashes, but historically, the market has always recovered and continued its upward trend. Take a look at the S&P 500 index, for example.

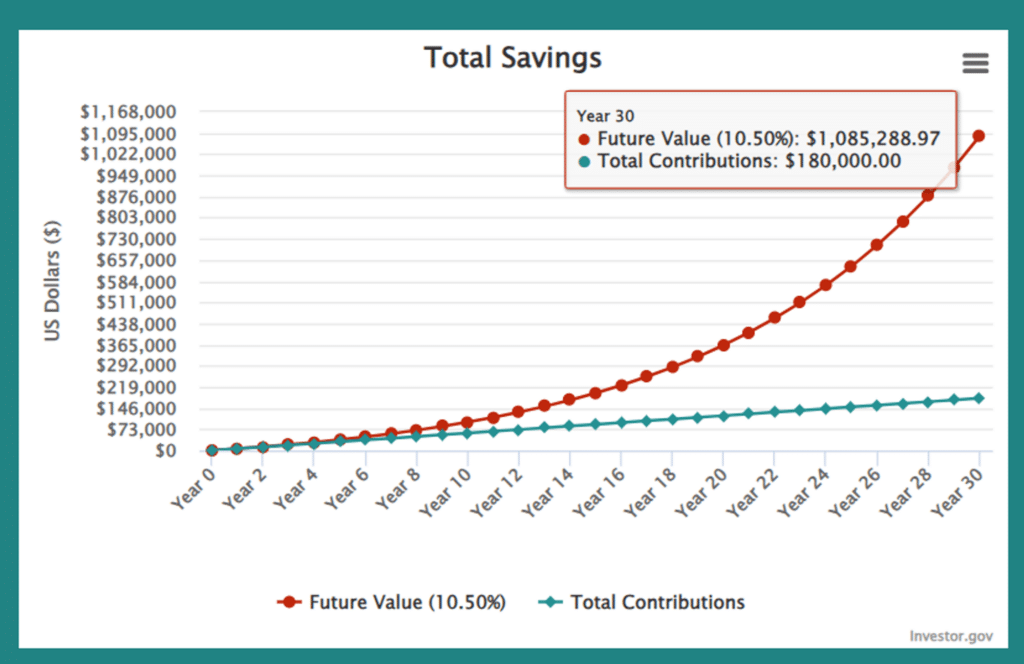

Since 1957, the annual average return of the S&P 500 has been 10.50%.1Source: SmartAsset

So if you invested $500 a month for 30 years as shown in the graph above, regardless of the market conditions, you can become a millionaire.

Do not let fear drive your investment decisions. Trust in your fellow human beings. As long as we keep showing up at work, our economy will grow.

2. “Here’s how to get guaranteed returns.”

Give me $1000 and I’ll give you $200 every year, guaranteed.

This one sounds enticing, doesn’t it? Who wouldn’t want guaranteed returns on their investment? But remember the old saying: “If it sounds too good to be true, it probably is.”

Certain people will promise set percentage returns every year, say 20%. But the reality is, there’s no such thing as guaranteed returns in the stock market.

This technique was famously used by Bernie Madoff, who ran the largest Ponzi scheme in history. Since Madoff was a former Nasdaq chairman and a respected investor, he had his credentials. So people trusted him when he said he could guarantee very high returns for their money.

Years later, they found that Madoff was just circulating his investors’ money around as “returns.” He didn’t actually invest the money or achieved any returns.

The result? Investors lost over $17.5 billion.

The lesson here is to always be skeptical of huge claims. Even when it comes from trustworthy figures who people trust without doing their due diligence. Reputation alone is not enough to trust someone.

3. “Inflation will kill your money’s worth!”

The fear of inflation has been around for a long time. Some people will tell you that inflation is about to skyrocket again, and your savings will be worth nothing.

They’ll suggest investing in commodities, bitcoin, or other assets as a hedge against inflation.

Yes, inflation can impact your purchasing power. But it’s not the end-all, be-all.

- Central banks around the world have tools to manage inflation.

- A healthy economy will self-correct the supply and demand dynamic, which ultimately determines the actual inflation.

- When demand is high, prices go up. But give the economy enough time to get the supply up, and prices will go down again.

Contrary to what these fearmongers might want you to believe, we might even see deflation in the coming years. The tech-focused investor, Cathie Wood, said:2Source: Yahoo! Finance

“Investors are worrying about the wrong thing… The bigger risk here is deflation, not inflation. And we’re seeing more and more signs of it.”

Deflation happens when there is a decrease in the general price level of goods and services. This can occur when there is a drop in demand for these items, causing businesses to lower their prices. It can also happen when there is an increase in productivity, making it easier and cheaper to produce goods.

So while inflation may be a concern, deflation can also have negative impacts on the economy. It can lead to decreased consumer spending and business profits, which can then spiral into job losses and economic recession.

Knowledge will safeguard your money

Information is your best defense against manipulation and fear-mongering.

The more you know, the better equipped you are to make sound financial and investing decisions that align with your goals.

Remember to keep a healthy level of skepticism. Don’t let fear dictate your choices. Instead, arm yourself with knowledge and make decisions based on facts, not emotions.

I’ll leave you with a quote from Warren Buffett:

”Risk comes from not knowing what you’re doing.”

So, educate yourself and stay informed. Charlatans don’t like people who have knowledge about investing. They prefer to prey on the ones who don’t.